Meta and Microsoft sold patents in Q3, AST Patent Deals Report shows

12/11/2025

Meta and Microsoft sold patents in Q3, AST Patent Deals Report shows

11 December 2025

Meta, Microsoft, Hitachi, Samsung, Sony and TCL were among the multinational corporations that participated in the US secondary patent market in the third quarter.

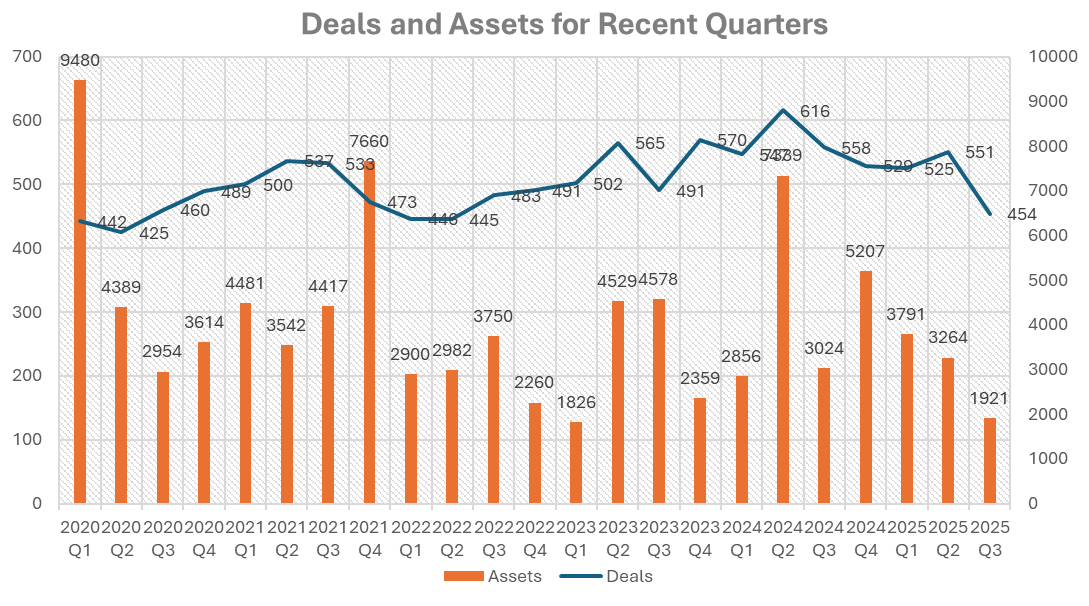

The latest Allied Security Trust Patent Deals Report reveals that during the third quarter, the US Patent and Trademark Office recorded more than 450 transactions that included more than 1,900 assets. These transactions involved 441 sellers and 425 buyers.

Some of the major, high-value transactions were:

- Advanced Lighting Technologies sold 196 lighting assets to Ni Wang and Massand, an NPE;

- AUO Corp sold 101 semiconductor assets to Equip IP Management; and

- Cummins Inc sold 81 industrial assets to GE Vernova.

“Despite inflationary pressures and policy ambiguity, market liquidity remained strong, supported by sustained corporate portfolio realignment and the steady influx of institutional and non-practicing entity (NPE) investment,” says the report. “IP monetisation remains strong as both operating companies and financial investors pursued high-value technology assets. The deal and M&A activity observed in Q3 2025 reflects a sustained appetite for strategic patent acquisitions.”

Source: AST Patent Deals Report

The leading technology categories were semiconductors, lighting and computing systems. Looking closely at the parties, universities and research institutions were key sellers, participating in 99 transactions. The report mentions that 29% of buyers were non-practicing entities. Some patent assets they purchased already showed up in patent litigation against Apple, ASUSTek, HPE, Intel and other companies, the report says.

“In Q3 we saw a resilient and increasingly competitive patent market. NPEs accounted for nearly a third of all acquisitions, and several newly formed NPEs moved into litigation within weeks of buying assets,” comments Mihir Patel, AST’s executive vice president of licensing and analytics, in an email. “This trend heightens the need for operating companies to track the market closely and secure defensive positions earlier.”

Buyers: OpCo’s v NPEs

AST included new information in its Q3 report by placing large transactions into categories: patent sales; M&As; and licence agreements.

The top patent sale deals are shown in Table 1. The NPE buyers on the list are Ni Wang and Massand, Equip IP Management and Crestone IP Management.

Table 1: Top deals in Q3

| Assignor | Assignee | Assets | Technology |

| Advanced Lighting Technologies | Ni Wang and Massand | 196 | Lighting |

| AUO | Equip IP (subsidiary Neolayer) | 101 | Semiconductor |

| Cummins | GE Vernova | 81 | Industrial |

| Microchip Technology | Crestone IP | 51 | Electronics |

| United Microelectronics | Stellar Semiconductor Japan | 44 | Semiconductor |

Source: AST

Company business acquisitions accounted for three large patent deals in Q3:

- Panasonic sold a majority stake in Panasonic Automotive Systems to Apollo Funds, leading to a 220-patent transfer.

- America Movil sold its TracFone Wireless subsidiary to Verizon Communications for $6.25 billion; they traded 196 patent assets.

- Sensel sold its notebook PC haptic forcepad business to Cirque, and it included 123 patent assets.

The report adds that a 14-asset transaction between Merlyn Mind and Promethian related to an exclusive US licence to distribute Symphony Classroom AI technology in the education sector. Also, 11 patent assets transacted from Orckit Communications to Enhanced Data Streaming, an NPE, based on a licence granting the assignee rights to sue and enforce and requiring 70% revenue sharing with Orckit.

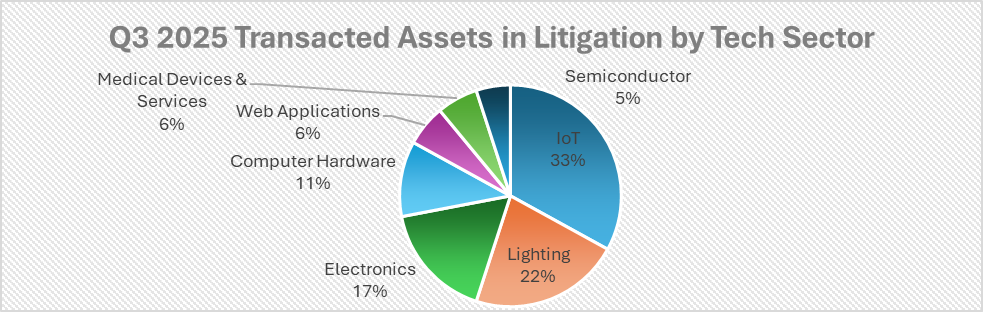

AST has flagged some of the NPE buyers as: Ni Wang and Massand; Equip IP; Crestone IP; Aesthete Holding; R Hewen and Co; Mercury Pointe; Capcab; Stevens Law Group; and Memray. The report shows that the patents that wound up in litigation mostly covered the Internet of Things, lighting and electronics sectors.

Source: AST

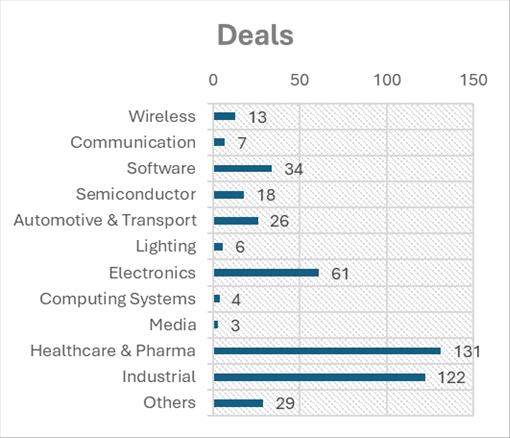

Among the 454 deals in the quarter, 29% were in the healthcare and pharma sector, 27% were in industrial, and 17% were in electronics.

Source: AST

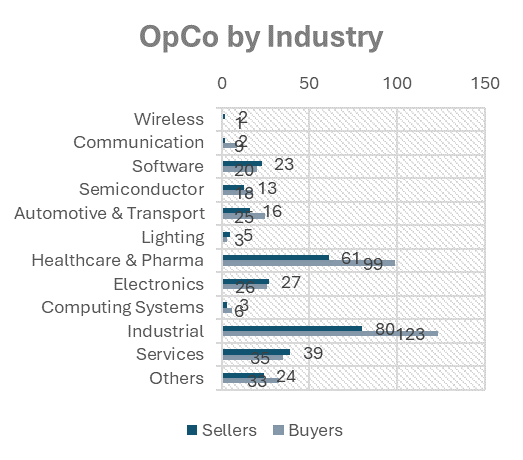

Software companies like GREE Holdings, Meta and Microsoft were patent sellers in the quarter, and big electronics companies were among the buyers, including Hitachi, Samsung, Sony and TCL. As always, there were a lot more operating companies among both buyers and sellers than any other type of entity. The number of buyers outpaced the number of sellers in both the industrial and healthcare and pharma sectors.

Source: AST

Among other noteworthy deals, AST reported that Acer sold 12 wireless assets to General Video, an NPE; and Seiko Epson sold nine electronics patents to IPValue Management. Also, the Electronics and Telecommunications Research Institute (ETRI) sold five patents to Telechips and one to Intellectual Discovery, an NPE. In addition, Intellectual Discovery bought three patents from Siemens.

Top sellers and buyers

AST reported the top sellers by number of deals, shown in Table 2. RG Africa and Piece Future are both NPEs, says the report.

Table 2: Top sellers in Q3

| Rank | Seller | Deals | Assets | Industry |

| 1 | University of Virginia | 4 | 4 | Industrial |

| 2 | Friedrich Alexander University of Erlangen Nuremberg | 4 | 4 | Healthcare and Pharma |

| 3 | Merck & Co | 3 | 52 | Electronics; Semiconductors; Healthcare and Pharma |

| 4 | RG Africa | 3 | 11 | Electronics and Computers |

| 5 | Piece Future | 3 | 7 | Software and Electronics |

Source: AST

The top three buyers in the period were Siemens, the University of Virginia Patent Foundation and Nokia, which purchased assets related to wireless, industrial and healthcare and pharma technologies. Details on top buyers are shown in Table 3. Both Ni Wang and Massand and Jeffrey M Gross are NPEs.

Table 3: Top buyers in Q3

| Rank | Buyer | Deals | Assets | Industry |

| 1 | Siemens | 6 | 15 | Healthcare and Pharma |

| 2 | University of Virginia Patent Foundation | 4 | 4 | Industrial |

| 3 | Ni Wang and Massand | 3 | 235 | Electronics and lighting |

| 4 | Jeffrey M Gross | 3 | 11 | Electronics and wireless |

| 5 | Nokia Corp | 3 | 9 | Wireless |

Source: AST

The report also notes that Mitsubishi Group bought one software patent from the National Institute of Advanced Industrial Science and Technology, and one industrial asset from Precision Couplings.

https://www.iam-media.com/article/patent-transactions-in-q3-2025