IBM was Q2’s top patent seller, while Samsung was most frequent buyer

Shutterstock/Nick N A

During 2025’s second quarter, some of the well-known patent sellers included Huawei, LG, Panasonic, Philips and Sony, who collectively sold 254 assets in 38 deals, reports Allied Security Trust. On the buy side were companies like Intel, MediaTek, SG Micro Corp and SK Group, who acquired 133 assets in 10 deals.

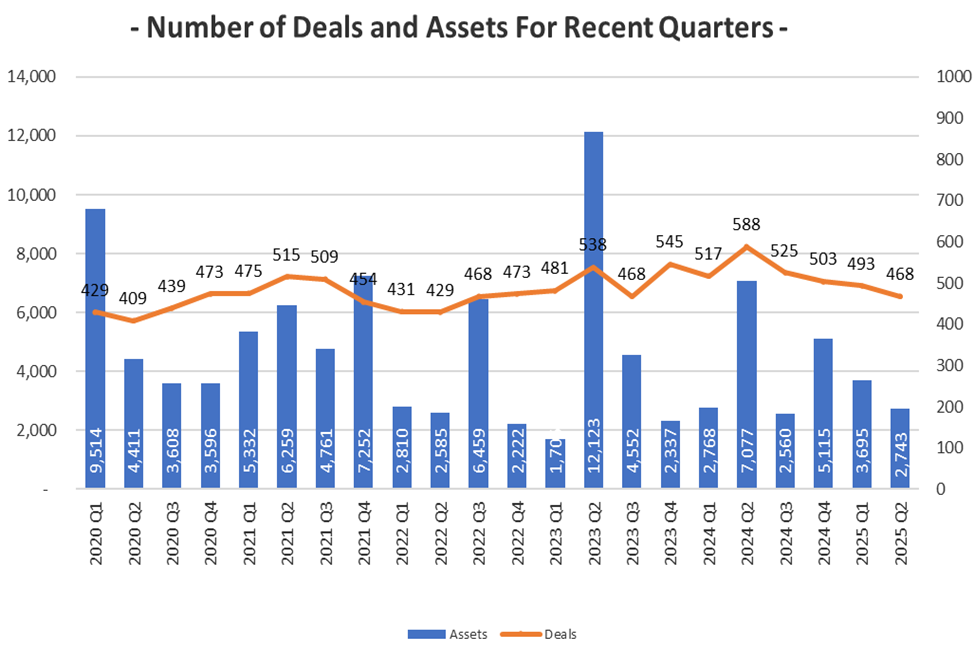

The AST Patent Deals Report for Q2 2025 shows there were 468 patent sale transactions involving 2,743 assets from April to June 2025, which semiconductor and wireless patents leading the pack.

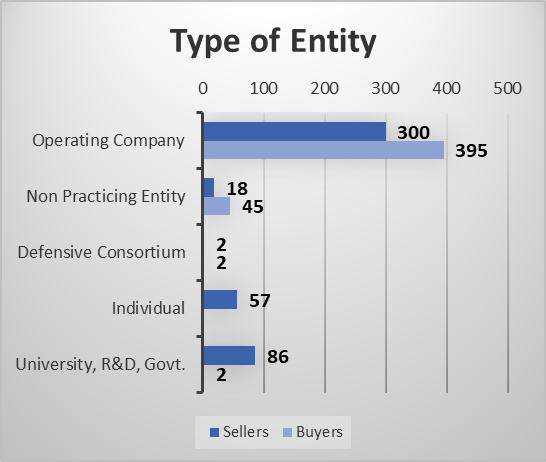

The Q2 transactions involved 463 sellers and 444 buyers – and 57 were non-practicing entities, including Fortress Investment Group and IPInvestments Group. AST reveals that seven of the patent sales have spurred 21 litigations against Amazon, Acer, Verizon, Walmart and others.

“Litigation funders and finance vehicles are increasingly shaping market dynamics by enabling NPEs to pursue large-scale acquisition and enforcement strategies. These backers increase competitive pressure on operating companies and accelerate the pace and scope of litigation campaigns,” AST reported. “With discretionary denials of IPRs on the rise, NPEs are more emboldened and are likely finding it easier to secure financing—making them even more challenging negotiation counterparts.”

Source: AST

Source: AST

There is always a delay in patent sale recordings with the US Patent and Trademark Office. Because of this, AST is reporting revised Q1 numbers: 32 more assignments linked to 28 deals, bringing the total deals number to 493 (+6%). The same thing will happen with Q2’s figures.

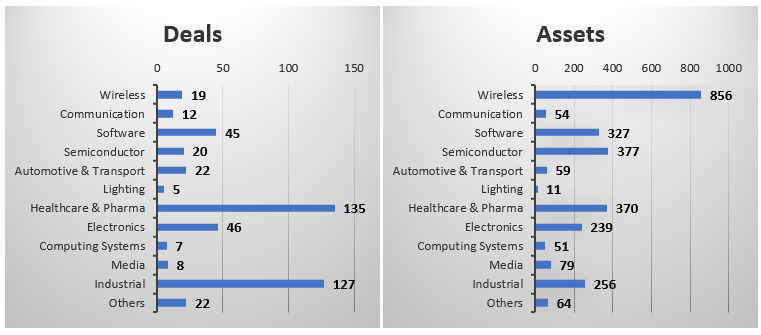

Wireless technology assets were involved in 31% of the deals in Q2, followed by semiconductor with 14% and healthcare and pharma at 13%.

Most of the buyers and sellers were operating companies. Although there were only 45 NPE buyers, they scooped up 45% of the assets in secondary patent market sales in Q2.

Source: AST

Source: AST

“Newly formed NPEs represented 5% of transactions, several of which initiated litigation within weeks of acquisition during the quarter,” the report notes. “These trends point to elevated litigation risks, a more aggressive posture from funded NPEs, and increased competitive pressure on high-tech companies to monitor, acquire, license, or otherwise neutralize at-risk patents before they enter assertion channels.”

During Q2, academic institutions were the sellers in 95 deals, such as Fraunhofer Gesellschaft’s patent sales to Via Licensing and Hanwha.

Top deals

The transaction between Langbo and Fortress was the largest at 532 assets covering wireless technologies. IAM reported on this transaction in April, noting that the US portion of the portfolio was joined by international assets and the total portfolio was nearly 2,000 assets. The buyer was Apogee Networks, which is owned by a Fortress-managed fund. Apogee will license the patents to 5G mobile device manufacturers, network operators and network equipment providers.

| Seller | Buyer | Assets | Industry |

| Langbo Communication Technology Co | Fortress Investment Group | 532 | Wireless |

| Intellectual Ventures | IPInvestments Group | 141 | Wireless |

| Sandisk | Samsung | 113 | Semiconductor |

| IPVALUE Management | Equitable IP | 101 | Semiconductor |

| MOSAID Technologies | Mediatek | 88 | Wireless |

Source: AST

The report highlights some other interesting deals involving high-profile companies, which may show a change of technology focus, and NPEs, which indicate litigation risk. For example, Adeia, a San Jose-based patent licensing company, bought 18 media assets from PRJ Holding Company. Acer sold 17 electronics assets to Key Patent Innovations, a patent licensing company in Ireland that licenses the BlackBerry portfolio, among others.

Top sellers

IBM was a repeat seller during Q2, selling patents to Abnormal AI, Anthropic and Dexcom. Sony also closed multiple transactions as a seller to InterDigital and Tetra Laval Group. AST shows that universities and R&D institutions participated significantly in the patent market during the period. Three of the top 11 sellers were academic institutions, and that includes the University of Minnesota in the top five list below.