Include Patent Numbers, Marketing Materials, Claim Charts, Price Expectation, and Bid Deadline.

We are a Member-driven cooperative that provides to some of the world’s most innovative and recognized technology companies patent risk mitigation services, market insights, and a forum for IP leaders to interact and form business relationships.

Our unique non-profit model means that Members come first every day.

AST analyzes US Patent and Trademark Office (USPTO) patent assignment records and gathers data from numerous public sources. This report highlights activity in the patent deals market during the third quarter of 2025. In Q3, the U.S. secondary patent market continued to exhibit resilience and momentum amid ongoing global uncertainty. The USPTO recorded 454 patent sale transactions involving 1,921 assets, with participation from 441 sellers and 425 buyers. Despite inflationary pressures and policy ambiguity, market liquidity remained strong, supported by sustained corporate portfolio realignment and the steady influx of institutional and non-practicing entity (NPE) investment.

Emerging Growth Companies: Targeting 11,000 Series C and beyond startups with more than $100M in funding, and less than $500M in revenue.

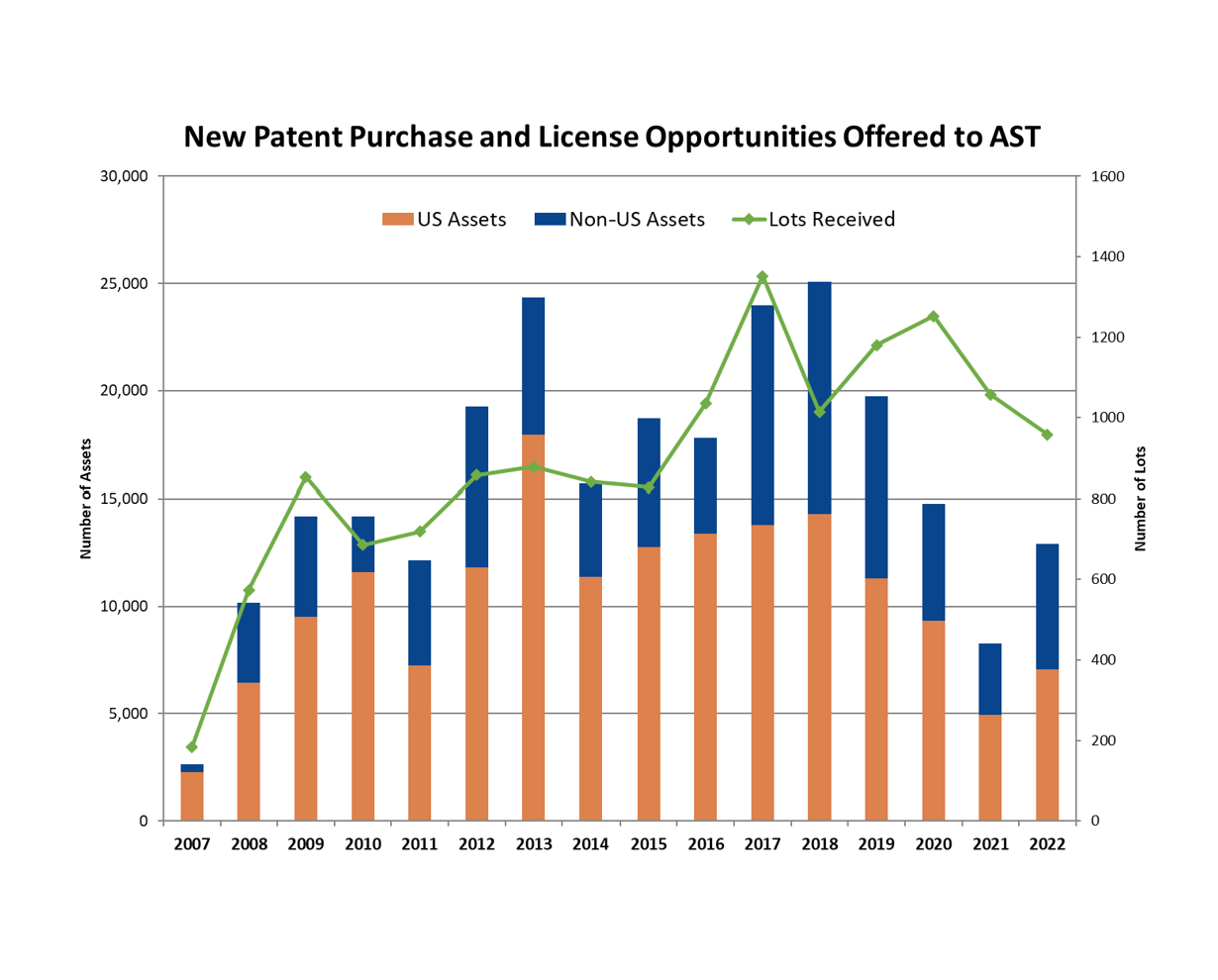

AST receives on average over 1200 patent purchase opportunities per year

Since its inception in 2007, AST has been offered over 20,000 patent portfolios comprising over 350,000 patent assets

7,000+ patent sellers as well as over 700 brokers have worked with AST over the years. AST has done 650 deals comprising thousands of assets on behalf of its members

Over $500M spent in acquiring patent rights helping Members to avoid 1500+ litigations

Over 13,000 U.S. litigations have been filed involving patents that AST received prior to the filing of the litigation, with 93% of those cases initiated by Non-Practicing Entities (NPEs)

Approximately 32% of all U.S. litigations filed are using patents that were on the secondary market

Industry Testimonials

Google is pleased with our membership in AST – Its business model is among the ways we mitigate the risk of future patent litigation for Google products and services. Google entrusts the AST team to handle intake of third-party offers for patent sales and to facilitate the processing of those opportunities for consideration.

We worked with AST to secure a license to a portfolio that has since been litigated against several other companies in our industry. The AST transaction was smooth, efficient and at a significantly lower cost than we would have faced if we had not acted proactively.

As part of our pricing study completed in the first half of 2016, comparing some of the most active buyers in the secondary market, we found that AST’s prices have been right in the middle. They neither overpay nor underpay on behalf of their members, but seem to pay a reasonable market price.

AST brought one of our portfolios to the attention of a member of theirs, who ultimately bought it. While we had offered the portfolio to the company directly, and received other offers to acquire the portfolio, it was AST’s involvement that caused them to really consider the portfolio, and I believe ultimately contributed to the sale. That’s one of the great things about AST – their members can either buy through AST, or directly with a seller. I look forward to more successful transactions between Adapt IP, AST, and AST’s members.

AST are a pleasure to work with. They are responsive, price competitive and very detail orientated.

AST operates with the highest integrity when buying or selling patent portfolios. When buying, AST is efficient and reliable – performing due diligence, submitting bids, and negotiating the patent sale agreement within the requested timeframes. When selling, AST is pragmatic as to the sale price and quickly responds to buyer questions and issues. AST understands the patent transaction market and is always moving transactions towards closing.

I’ve seen over one hundred patent purchase agreements. For a seller, some are complete deal killers. AST’s agreement is the exact opposite. It takes discipline and experience for a buyer to get what they need and no more. AST benefits from both, and so do sellers that close deals with them.

An Overview Of How AST Works

Portfolio of Patents for Sale Submitted

- Step 1 -

Portfolio Reviewed

- Step 2 -

Ensuring offering is within the scope of patents that Member firms are searching for.

Portfolio Listed for Member Consideration

- Step 3 -

fAST IP is the AST Members-only, password-protected, web-enabled database of portfolios available for sale.

Interest in an Offering

- Step 4 -

Members may take 60-90 days to determine if there is initial interest in an offering.

Frequent Portfolio Status Updates

- Step 5 -

New supporting materials provided.

Purchase Offer Presented

- Step 6 -

If there is interest, AST offer is made on behalf of our Members.

Patent Purchase Process and Due Diligence

- Step 7 -

- Patents Acquired

- Efficient and timely closing process

Obtain & Distribute Patent Purchase Opportunities

- Step 1 -

- Worldwide network

- Analysis, technical assistance, and due diligence

- Distribution and evaluation through web-based fAST IP

Solicit Member Interest

- Step 2 -

- Members make bidding and funding decisions

- AST pools bids

- Bidding is collaborative but confidential

Engage the Seller

- Step 3 -

- Negotiate with Seller

Acquire Patents

- Step 4 -

- Assure all chain of title and other legal issues are resolved

- Efficient and timely closing process

Establish Licenses

- Step 5 -

- License Members that funded acquisition

- Licenses are fully paid-up, irrevocable for the life of the patents

- Provide subsequent license options to Members

Divest Patents

- Step 6 -

- AST does not hold patents

- All patents are divested

- Proceeds distributed to Members that funded acquisition